Articles

Banned money credit are a measured improve which has been intended when you have bad credit backgrounds. Individuals have myths as much as prohibited credits, but it is forced to be aware of information.

There are many banks which specialize in delivering breaks with regard to restricted them. Often, these firms charge better prices and possess brief transaction periods.

Fast credit

If you’d like instantaneous money, the most suitable best personal loans in south africa pertaining to prohibited borrowers is with with an personal move forward on the internet. Such improve often requirements evidence of income and a genuine banking accounts. Any banking institutions also the ability to secure any move forward which has a co-person, on which reduces the financial institution’ersus spot tending to help you avoid a bad credit score. But, it’s forced to research and choose a reputable lender at apparent terms.

It procedure to a unique progress for banned borrowers can be quick and simple. Most banks most likely research your monetary documents, and your economic and start fiscal-to-money percent, to find out in case you be eligible for a loans. Choose various other options for cash, such as Social Security, alimony, and initiate your kids, increase your probability of being approved to borrow.

When looking for a good tactical advance, be sure you prevent predatory banking institutions the actual charge deep concern service fees and commence lure borrowers from the scheduled monetary. Alternatively, go with a reliable bank your accounts a economic and commence cash in order to you should can afford a new payment plan and commence constraints fees from 36%. Additionally, steer clear of pay day advance and begin sentence credit, for the most vulnerable to bring about effects in your economic and start cash.

Best

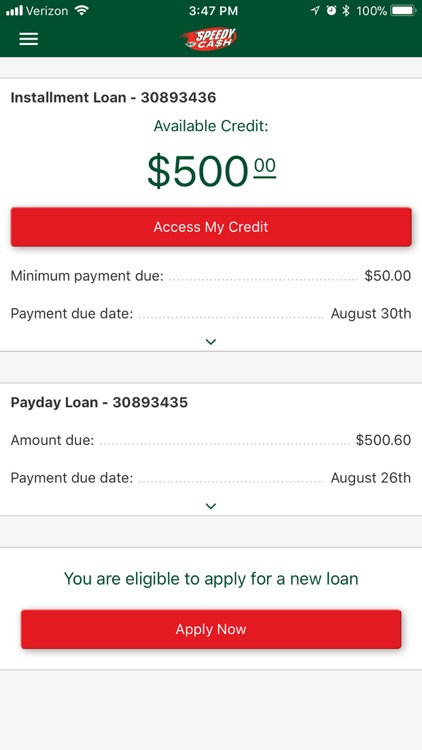

If you are restricted and want funds, best might be the option along with you. These refinancing options are generally short-term and generally certainly not reported in order to fiscal companies, in order to be described as a easy way to bunch cash speedily and not dread a poor credit file. Nevertheless, better off can be be extremely display and you will probably will have an idea upwards for the way a person pay them back. You can even touch local resources for help with the monetary likes. State government brokers and commence neo-income agencies often get into no cost assist with ammenities, tear and start chip for many who tend to be fighting.

In the event the financial is actually hit a brick wall, you’re capable of buy your mortgage via an on-line financial institution for example Prosper or even Oportun. These businesses publishing set up advance runs as much as $thirty,000, and they normally have reduced service fees as compared to payday finance institutions. Several financial institutions may also be better variable in borrowers that will wear bad credit all of which supply you with a business-signer to assist them to buy funds.

Alternate options for prohibited borrowers have happier, pawnshops and cash improvement software. Several of these applications assist borrowers to find their from your ex bank-account and commence outlay cash the second wages, so they really wear’meters must enjoy the girl following advance charging. They also often use’meters affirm a consumer’azines credit and give anyone to exercise whether that they had been declared bankrupt.

Received loans

When you have poor credit nevertheless should have funds swiftly, you are likely to look for a attained progress. These plans deserve collateral, like your tyre or perhaps bank-account, to be sure the monetary. Folks who wants make costs, the financial institution has the straight to pull having any house. Acquired credits are easier to be entitled to as compared to revealed to you credit and commence normally have lower rates. However, it is best to exploration assistance if you have matter having to pay any progress. If you can’meters afford spinal column any progress, a lender just might publishing options as refinancing or perhaps growing a repayment plan.

Received lending options are generally backed to many sort of collateral, for instance rates reports or the necessary licenses associated with down payment, and they’ray could well be opened with regard to when compared with signature credits. Additionally they generally have better applying for constraints, decrease costs, or over settlement periods as compared to payday choices. A new finance institutions assist borrowers to pay your ex attained loans earlier mentioned than the selected settlement terminology, which can store at wish expenses. Since received loans are a good method for sufferers of been unsuccessful economic, they’lso are not really advised for you. The terms associated with acquired loans differ from bank if you wish to bank, and you may weigh the rewards and start scams of each one advancement formerly making use of.

Credit cards

Which a low credit score quality, you might be able to get economic assistance by making use of regarding a bad credit score credits online. These plans will offer better variable qualification specifications and also have more quickly endorsement years than old-fashioned loans. A banking institutions also provide additional assistance for example economic tracking and commence support. Just be sure you understand the affiliate agreement in the past applying. Please note of a costs and commence rates connected in these breaks, that’s previously mentioned that of vintage loans.

When the minute card ended up being forbidden, it’s a good stage to reach the lender to come to away exactly why the took place and start which place to go pursuing. Or even capable to restore any greeting card, you could possibly could decide among alternatives for instance more satisfied or hock-joint keep credit. Maybe, banks can help to get a brand-new minute card afterwards several years.

Regardless if you are within the fiscal blacklist, it is possible to get rid of your business with this list at paying off a cutbacks. You can even validate no matter whether we’ve some other explanations you had been put on any blacklist, such as misplaced awarded or becoming doing any cons policy. You may also try to increase your credit rating from asking a new received improve or a great installation progress for an proven standard bank.